"Without hard work, nothing grows but weeds." – Gordon B. Hinckley

Or does it…?

Let’s start with a juicy question:

What does it really mean to be financially independent these days?

If you’re picturing someone sipping matcha lattes in Bali while effortlessly paying rent—think again.

Because, in reality, for many of us, “financial independence” looks more like crossing our fingers at checkout, hoping our card doesn’t decline.

So, let’s get real.

Are we all just faking it?

And more importantly—should we even be ashamed of getting a little (or a lot) of financial help from someone with deeper pockets?

Once I listened to his podcast I wanted to see a bigger picture here which I’m hoping to share with you today:

Words from the podcast:

Click here before listening and check yourself:

https://wordwall.net/resource/87912087

The Whispered Reality:

We don’t like to talk about it, but the truth is, a lot of people are quietly bankrolled by their parents—even well into adulthood.

This episode of Today Explained pulls back the curtain on this hush-hush reality.

Madeline Leung Coleman, a features writer for New York Magazine, explored this “open secret” in NYC—where seemingly independent young professionals are actually living off generational wealth. Some major takeaways:

Many people you assume are “self-made” actually have parental subsidies funding their rent, bills, or even buying their homes outright.

Women were far more willing to admit they received financial support than men—probably because of the social stigma around male financial dependence.

One interviewee’s parents bought her a studio apartment at 24, which eventually helped her and her husband buy a two-bedroom place. Now, she doesn’t even know what class she belongs to. Trust fund kid? Middle class? Who even knows anymore?

Trillions of dollars are shifting from baby boomers to their adult kids in what’s being called The Great Wealth Transfer, making it even harder to tell who’s truly financially independent.

This isn’t just a New York thing—it’s happening everywhere.

If you’ve ever wondered how your friend is affording that pricey neighborhood, there’s a good chance the Bank of Mom and Dad is involved.

Who are baby boomers and why are they so wealthy?

Baby boomers—those born between 1946 and 1964—are the financial heavyweights of today.

They hold a huge chunk of the world's wealth, and their financial stability often makes millennials and Gen Z wonder: How did they get so lucky?

Why Are Baby Boomers So Wealthy?

Post-WWII Economic Boom – Boomers grew up in a golden age of economic expansion. After WWII, countries (especially the U.S. and Western Europe) saw sky-high job growth, rising wages, and affordable housing.

Cheap Education – Unlike today, university tuition was either free or dirt cheap. Many boomers graduated debt-free and walked straight into stable, well-paying jobs.

The Real Estate Jackpot – Boomers bought homes when houses were actually affordable. Many paid off mortgages decades ago and are now sitting on massive home equity.

Pension Plans and Benefits – Unlike the gig economy of today, boomers had secure pensions, great healthcare benefits, and long-term job stability.

Stock Market Gains – They had time to invest when stocks were cheap, and they rode the wave of one of the biggest stock market booms in history.

How Are They Characterized?

Work Ethic – Boomers often see themselves as self-made, even if they benefited from an economic system that made wealth accumulation easier.

Loyalty to Companies – Many worked at the same company for decades, a concept that seems laughable in today’s job market.

Skeptical of Younger Generations – They often criticize younger people for “not working hard enough,” while ignoring the brutal economic realities millennials and Gen Z face.

High Homeownership Rates – Most own property and are not in a rush to sell, which drives up housing costs for younger generations.

Influence on Policy – They are a powerful voting bloc and tend to support policies that protect their wealth (e.g., resisting tax hikes on property or retirement income).

The Economy That Shaped Them

1950s–1970s: Golden Age of Capitalism – Low inflation, rising wages, and strong unions meant even the average worker could afford a house and raise a family on a single income.

1980s–1990s: Deregulation and Stock Boom – Many boomers benefited from Reaganomics, stock market expansions, and corporate-friendly policies.

2008 Financial Crisis? No Big Deal – Boomers were already well-established financially when the 2008 crisis hit. It devastated millennials just entering the workforce, but many boomers had assets that rebounded quickly.

So, Why Does This Matter Today?

Boomers control trillions in wealth and are now passing it down to their kids (hello, Great Wealth Transfer!).

Younger generations struggle with insane housing prices, student debt, and stagnant wages, making financial independence way harder.

Their policies and investment habits shape the economy, often in ways that keep younger people struggling (think: housing market shortages, healthcare costs, and job market conditions).

The Baby Bust: Why Millennials Aren’t Having Kids

Once upon a time, having kids was just what you did.

Now?

Not so much.

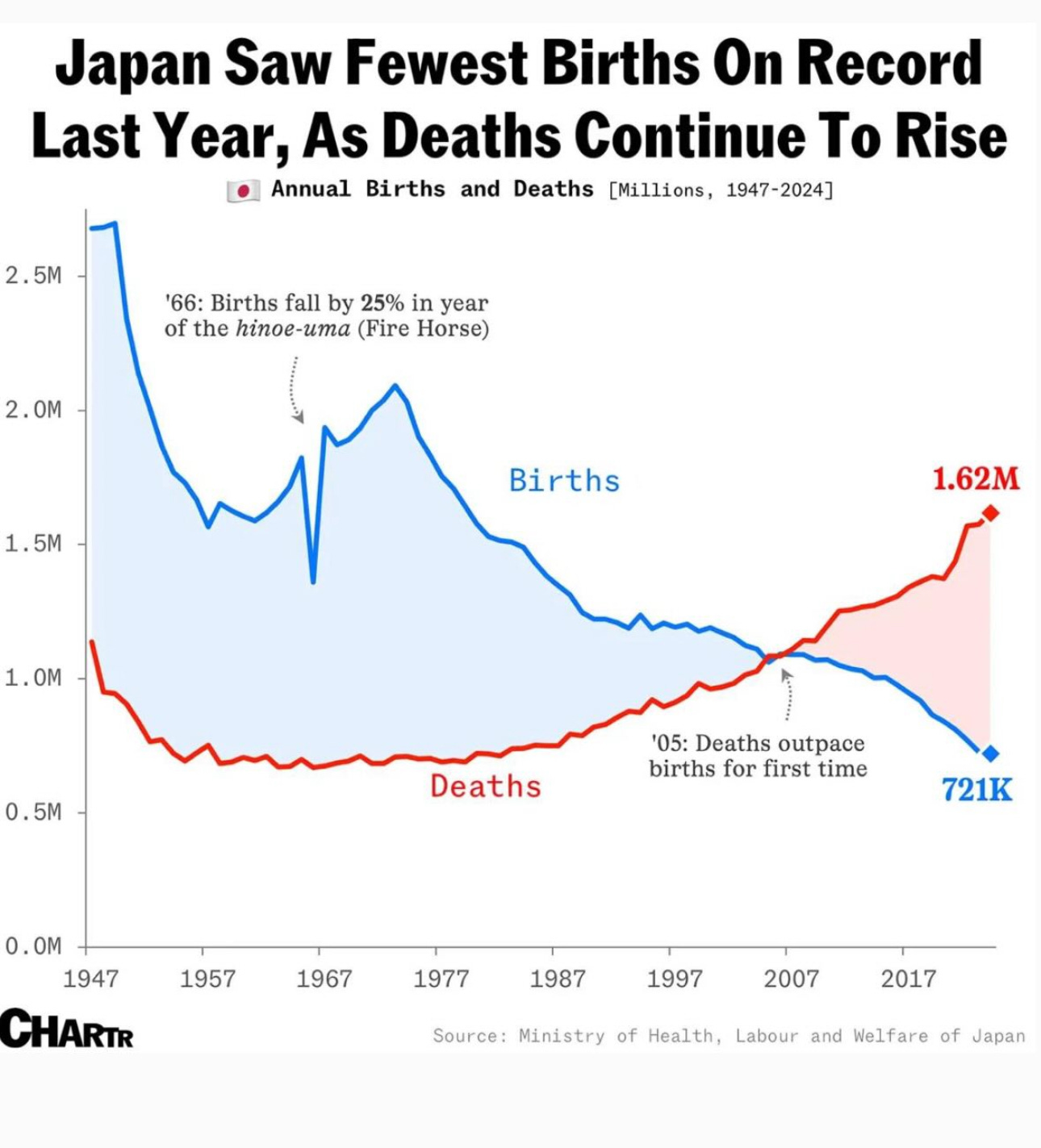

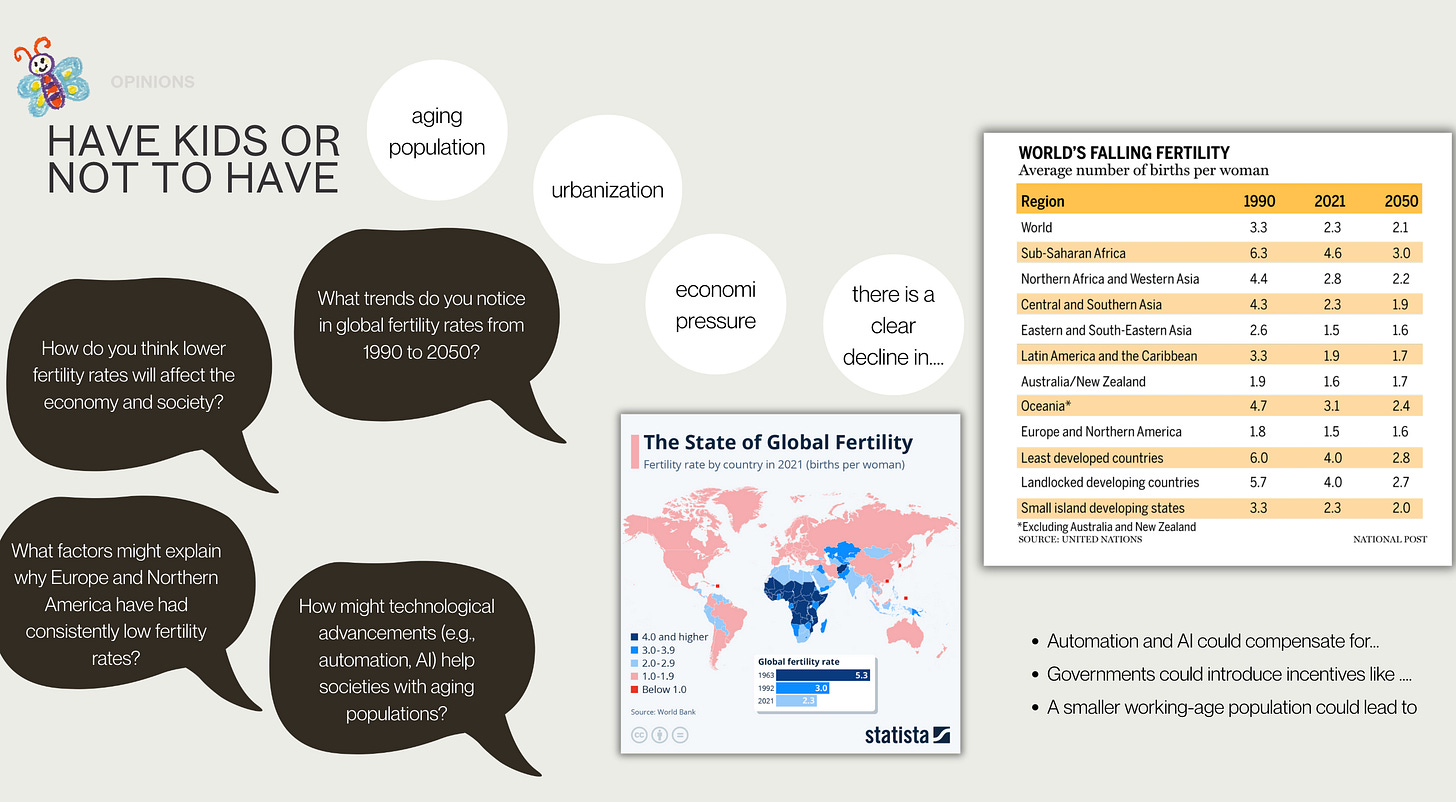

Birth rates are dropping fast, and millennials are leading the charge in saying “no thanks” to parenthood.

Why?

It’s too expensive – Raising a child today costs a small fortune. Housing, daycare, healthcare—it’s all brutally expensive.

Job insecurity – Many millennials are in precarious jobs, meaning steady income isn’t guaranteed.

Climate anxiety – Some don’t want to bring kids into a world facing environmental collapse.

Lifestyle priorities – Travel, personal freedom, and career ambitions often win over diaper duty.

Delayed life milestones – Many are still paying off student debt and struggling to afford homes. Having kids? That’s an afterthought—if even a thought at all.

The Pronatalism vs. Antinatalism Debate

Not everyone agrees on what to do about this baby drought. Some say we need more babies, while others think fewer is better.

Pronatalists argue that declining birth rates will tank economies and shrink the workforce. Countries like Hungary and Japan are paying people to have kids.

Antinatalists believe having kids is ethically questionable—some even argue it’s selfish to bring a child into a suffering world.

How Is Population Distributed?

Countries in Africa and South Asia still have high birth rates, but Europe, Japan, and North America are seeing sharp declines.

China is in trouble after decades of the one-child policy, leading to a shrinking workforce.

The U.S. birth rate is below replacement level, and immigration is playing a bigger role in sustaining population levels.

So, what does all this mean? Well, fewer babies today means big economic and social changes tomorrow. Are we heading toward a future with not enough young people to support aging populations? Or is this just the natural evolution of modern society?

Only time will tell. But for now? Millennials are keeping their options open—and their wallets closed to baby expenses.

What’s next:

There is a certain trend which I’ve noticed but correct me if I’m wrong.

If you watched Silo and Paradise you know what I’m talking about.

What vision of the world are we presented for humanity?

Both Silo and Paradise center around isolated, controlled, artificial worlds where survival is the only focus. In Silo, people are trapped in an underground bunker, cut off from the real world, while in Paradise, survivors are stuck in a harsh, unnatural environment.

In both shows, survival becomes the defining struggle, with characters living in worlds that limit their freedom and connection to reality.

If you haven’t seen the show yet highly recommend.

Keep reading with a 7-day free trial

Subscribe to SylwiaGlebicka-Think in English to keep reading this post and get 7 days of free access to the full post archives.